✨ volume 4 -- next wave of enterprise software (part 2 of 2)

the vertical SaaS playbook; companies that can execute it well; the coming innovation in enterprise software

In my last post (part 1 of 2), I covered the the history of enterprise software from the early 50’s through the late 2010’s, shifting from monolithic, clunky software distributed by one (or at most a handful) of vendors, to the emergence of cloud computing, and consequently, the mass proliferation of horizontal and vertical SaaS in the last two decades.

If you’ve just stumbled upon this and want more background or context before diving in, I highly recommend reading Part 1 first!

In this post, (part 2 of 2), I will focus on:

the current vertical SaaS playbook, with one particular case study, and what next-gen vertical SaaS “rebundling” to provide all-in-one solutions for entire industries might look like

the implications for vertical SaaS product innovation in the future (integrating payments, loans, insurance, etc. into offerings)

Disclaimer: I do not advise or own any stock in any of these companies. All opinions are my own. tl;dr bystander with thoughts.

part 1 - the vertical SaaS playbook and next gen software rebundling

In my last post, I covered the unbundling of horizontal SaaS for more niche, industry specific products (the rise of vertical SaaS). In the last decade plus, many have been very successful, and the playbook is straightforward (but substantively different than for horizontal players).

Identify the right market. Finding a market with industry-specific need for customizations that are underserved with current solutions

There are three main reasons why there is a need for vertical SaaS players:

It solves a problem that current horizontal players / incumbents have not yet noticed since they are industry agnostic

Incumbents have noticed but don’t believe the market is big enough to build a specific product line to target

Some barriers of entry which may exacerbated with scale (lack of agility). The industry is too regulated, too fragmented, sales cycles are too long, etc.

Build the product and do it exceptionally. Ensuring the customer experience is significantly better than what the incumbents offer, that there are proven results to integrating your software, and continuing to sell. The company becomes the product and the product the company.

Expand. Not just aggressively expanding the sales team, but expanding the product roadmap into logical adjacencies which unlock ever more product value and improve the product experience for clients. Cross selling into markets without sacrificing quality or experience. As contracts begin to pile up, building a sustainable business model and becoming profitable.

Many vertical software companies have been very successful doing following these three principles — targeting a clear, sizable market, building an exceptional product, and selling voraciously. Consequently, they have been rewarded for it, gaining traction, reaching profitability, with many even listing in the public markets (see Vobile Group, MTBC).

But innovation should not stop at profitability. The truly breakthrough vertical SaaS companies are redefining software solutions by adopting, in addition to the former tenants, the following standards:

Rebundle and become the industry’s “operating system” (“OS”). Transitioning from one product to a suite of products that cover a comprehensive set of workflows particular to that industry

Become the industry standard. Becoming the go-to software provider, the “bread and butter” for any player in the space.

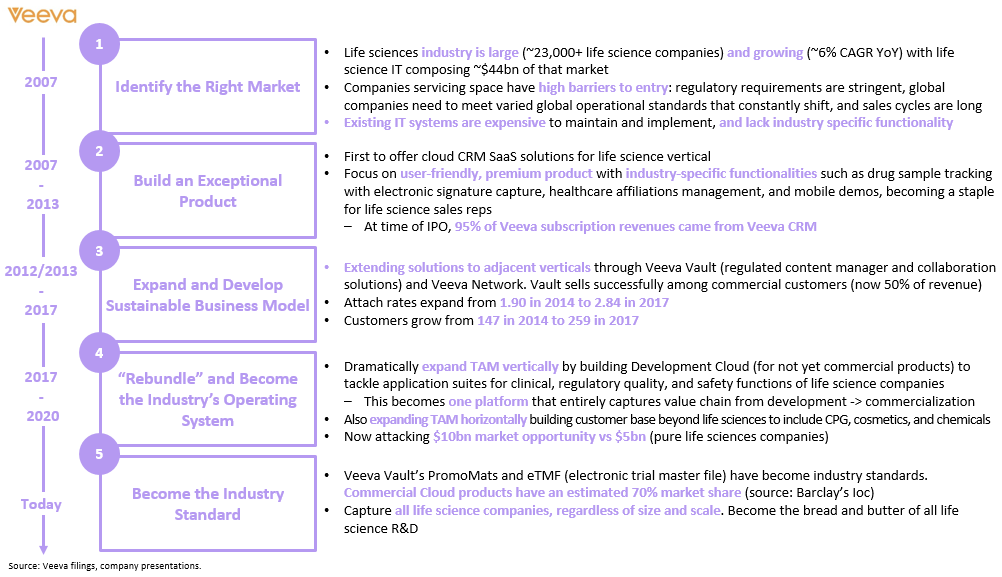

Here’s a handy infographic to summarize -

Source: Nat Jin

Perhaps the best example of a company that executed this strategy to the tee with high success is Veeva, a poster child for vertical SaaS.

~veeva case study~

Veeva was co-founded by Peter Gassner, former SVP of Technology at Salesforce / “the product guy”, and Matt Wallach, former CMO of Health Market Science / “the life science software guy”. At the time, horizontal cloud solutions such as payroll and expense management were offered, but solutions for more complex business functions did not exist in the heavily regulated and complex healthcare industry. In 2007, the two created an outstanding product — one that would dominate its niche, with 80% marketshare in CRM for life sciences, go public in 2013, and hit a $1.1bn run-rate in 2020.

Source: Piper Sandler IoC

How did they do it? Their playbook, line by line:

1. successful identification of the market

When Veeva first started many smart and diligent observers and VCs doubted whether it had chosen the right market. They wondered if focusing in on the CRM market solely in the life sciences would be enough greenfield to sustain a company, let alone successful one.

Veeva proved them wrong. The life sciences turns out to be a stellar market for vertical SaaS precisely because it has such specialized workflows and stringent regulations which required solutions to streamline and optimize the value chain. Incumbents existed, but were not specialized enough for this work flow, and existing solutions were built in-house and were difficult to upgrade and expensive to maintain.

Veeva entered the industry with a purpose built software that actually solved customer pinpoints and immediately gained traction in a high barrier to entry industry.

2. building an exceptional product

The life sciences industry is one of the most complex in the world, with stringent regulations to abide by and software that would need to reflect technical intricacies that varied from organization to organization. There are regulations where sales communication needs to be documented, marketing materials approved for misleading statements, all the while tracking versioning and dosing for nuances of every drug.

As such, prior to Veeva, life sciences companies faced two options to meet industry-specific needs in the mission-critical business functions of sales. Either:

Buy and operate on-prem IT systems or

Develop home brew solutions through hiring expensive software developers (when software development was not a core competency of their organization). Not appetizing in either direction

So when Veeva came out with a life science specific CRM, which had drug sample tracking, pre-authorization tracking, e-signatures, etc., the product was a hit. In an even more ingenious move, Veeva built their initial CRM product on top of Force.com from Salesforce, simultaneously getting a substantial head start on product development by building on then state-of-the-art cloud platform and sidelining the potential competition in one fell swoop.

3. expanding into logical adjacent offerings without compromising quality

Veeva did such a great job with CRMs, they systematically began introducing new solutions for adjacent workflows in sales and marketing, therapeutics development, new drug submissions, and safety training and quality management, among others. This dramatically expands their addressable market through increasing the breadth of customer experience held within the Veeva product.

A nice chart of Veeva’s steady drumbeat of product development over the past decade:

Source: Veeva JPM 2020 Investor Presentation

4. “bundling”, and transitioning from one core “wedge” product to an entire suite of offerings - a software “OS” for the company

With so many new product offerings on the same platform and an improved user experience, Veeva started becoming the central software hub for its clients. A life science company has a few essential stages in its product cycle - develop a drug through R&D and by testing it in clinical trials (Clinical Data Management, Clinical Operations), have the drug approved by regulators (Regulatory), produce and manufacture the drug (Quality and Safety) and deploy a commercial team to sell the drug and educate physicians on how to prescribe it (Medical and Commercial). Veeva started off solely as a CRM, but eventually rolled a software solution to each of these activities and assimilated them under one platform umbrella.

Source: Veeva JPM 2020 Investor Presentation

5. doing it all so well veeva became a life science standard software

After more than a dozen years, Veeva has become a force in the life science industry. Many of the large Pharma players have adopted its software in some form. It is recognized by client industry execs as a highly sought after control nexus which can serve as a reliable partner in achieving their commercial goals.

So recap — Veeva has made incredible strides in the last decade, executing on a well known playbook. More details below:

Source: Nat Jin

part 2 - future vertical SaaS integrations and innovation

This trend of product development in order to become an “operating system” for a particular vertical is found not just in life science CRMs. This theme is also starting to play out for innovations in other SaaS verticals, particularly those with a customer facing component.

Toast, a restaurant management software, started as a point of sale hardware vendor and now is also a comprehensive software offering, including back end logistics, customer facing activities, and platform analytics.

Source: Toast website

In another example, MindBody is a yoga study software provider that has done much of the same in that space by creating an all-in-one product where the entire value creation workflow is captured on the platform.

One area these vertical softwares solutions traditionally did not have was payment processing. However, innovation is happening here as well. Finix is a startup that allows SaaS providers to become payment facilitators, which in short means these vertical software providers can now process payments directly from individual customers on behalf of their clients (and also take a cut of the interchange fee that otherwise would be taken by a third party payment facilitator!).

This is powerful in that, from a product perspective, once you add in the capability to process payments, a comprehensive software package truly comes full circle in capturing the value added services of a client. For MindBody for example, this would mean capturing the logistics, scheduling, feedback forms, as well as payments. From a financials perspective, this product capability adds a second revenue stream to the same customer base.

Taking this innovation one step further in its natural evolution, if vertical SaaS providers are processing payments for their clients, they could conceivably also offer financial products as additive services. Vendor financing, working capital management, and other loan instruments could all be offered to clients and comprise yet a third channel of revenue for the SaaS provider.

The next wave of innovation in vertical SaaS will be interesting to follow; and brings us full circle to where we started Part 1 of this series “The Next Wave of Enterprise SaaS”, where we discussed large, monolithic companies that provided a suite of solutions for all the software needs of its clients. These were eventually superseded by cloud solutions, which then evolved into vertical SaaS solutions — which are now re-bundling into the “OS” of a company. Sound familiar? These new-age offerings share certain similarities, but, of course, are vastly different from the software of the day decades ago. Looking forward to following the next wave of developments for enterprise software in the years to come.

Spent a lot of time focused on verticals that had the opportunity to bundle software and monetize payments, which is still a key thesis area for growth investors. Even though Finix is still very early, completely agree that the company will for sure fuel new offerings to help vertical SaaS businesses improve retention + ACVs in a way new tech features cannot