✨ volume 3 -- next wave of enterprise software (part 1 of 2)

the evolution of enterprise software innovation from mainframes to cloud computing; predictions on the next wave of software innovation

On Valentines Day 2020, Toast announced the completed fundraising of $400mm, valuing the company at a whopping $4.9bn. This nearly doubled their valuation from only ten months prior, when they fundraised $250mm at $2.7bn.

For those outside of the B2B software and/or VC bubble, Toast started as (and still is) a POS (point-of-sale) system for restaurants. They offer hardware, software, and payments to SMB restaurants. (Think Square but with special restaurant-specific features.)

Over time, Toast built in additional features from reporting and analytics to payroll and team management software (HCM) to online ordering and delivery. They essentially identified all the needs of a restaurant operator and built one easy-to-use, unifying platform solution to address them. Toast, effectively, is moving towards become the “operating system” of the restaurant business.

Their vision has been well-received. In the last year, Toast added “tens of thousands” of new customers, and revenue grew 109%.

Is this platform play, carving a wedge inside a vertical, bundling a series of offerings, and selling it to enterprises the next wave of enterprise software? And what have been the waves of enterprise software development?

In this post (part 1 of 2), I touch upon

the history of enterprise software

the emergence of cloud native enterprise software

the proliferation of vertical SaaS.

In the next post, (part 2 of 2), I will focus on a few case studies of

effective vertical SaaS “rebundling” to provide all-in-one solutions for entire industries (i.e. Toast, Veeva, etc.) and

the implications for vertical SaaS innovation in the future.

***note: some themes are broadly covered / less technical as this is not meant to be an analysis on historic enterprise software

part 1 - the origin of enterprise software and the age of the monolith

In the 50s, 60s and a significant part of the 70’s, enterprise software was all about buying all your software from one company and running it on one ecosystem. IBM dominated the market with Mainframes, leasing the computers and owning the software, peripherals, services, and maintenance to customers at a bundled price (the software was only IBM machine compatible but offered for free).

In 1969, due to anti-trust concerns, IBM unbundled its software services from hardware sales. Software services involving the maintenance and upkeep of IBM products remained free, but other add-on services such as data management or enterprise planning, now charged a fee. The monetization of these additive software services effectively sparked the beginning the competitive enterprise software solutions, resulting in the founding of players like SAP (founded 1972) and Oracle (1977).

SAP and Oracle provided upgraded continuations of IBM’s legacy software and database management (in fact, SAP was founded by ex-IBM employees). Throughout the 70s and 80s, they creeped up on IBM’s market share and offered large enterprises suites of ERP, CRM, and HCM software on top of their on-prem databases.

Although the “unbundling” of IBM was significant, in moving enterprises away from one provider to a handful of different software providers, the barriers to entry for software development were still very high. Enterprise databases built a wide moat. They were (and still are) hard to move from one server to the next. Customers were highly sticky. Programmers were less abundant. And smaller “tack on” software solutions were a hard sell, as companies were highly brand loyal and touted themselves for being “all-IBM” companies. Therefore, for the next two decades, the status-quo, the old guard (IBM) and its new competitors (MSFT, SAP, ORCL) dominated sweeping up enterprise software market share.

Source: IBM

part 2 - SaaS and cloud reshape devops

Two major changes in the late 90s and early 2000s narrowed the moat around software development. The first, a new transformational way of pricing, distributing, and upgrading software (the SaaS model) and the second, a revolutionary cloud technology to democratize computing resources.

a. The Emergence of the SaaS Model

Founded in 1999 by Marc Benioff (then former VP @ Oracle), Salesforce changed the way consumers thought about enterprise software. Prior to Salesforce, enterprise software was purchased for multimillion-dollar up front costs, endured implementations that could take years, and suffered complexities from maintenance and constant upgrades (which took place on premise). The company instead offered a pay-as-you-go subscription model for the software, with straightforward implementation and UX, and software upgrades rolled out 3x a year to all subscribers via the cloud. Salesforce was wildly successful. In 2004, Salesforce announced its IPO, and on the first day of trading, the company made headlines as NYSE:CRM closed 56% above its offering price by the end of its trading day. The company had survived a dot-com bubble burst, continued its accelerated growth plan, and paved the way as the first SaaS business model.

The SaaS model makes sense for both the consumer (enterprise company) and the software provider.

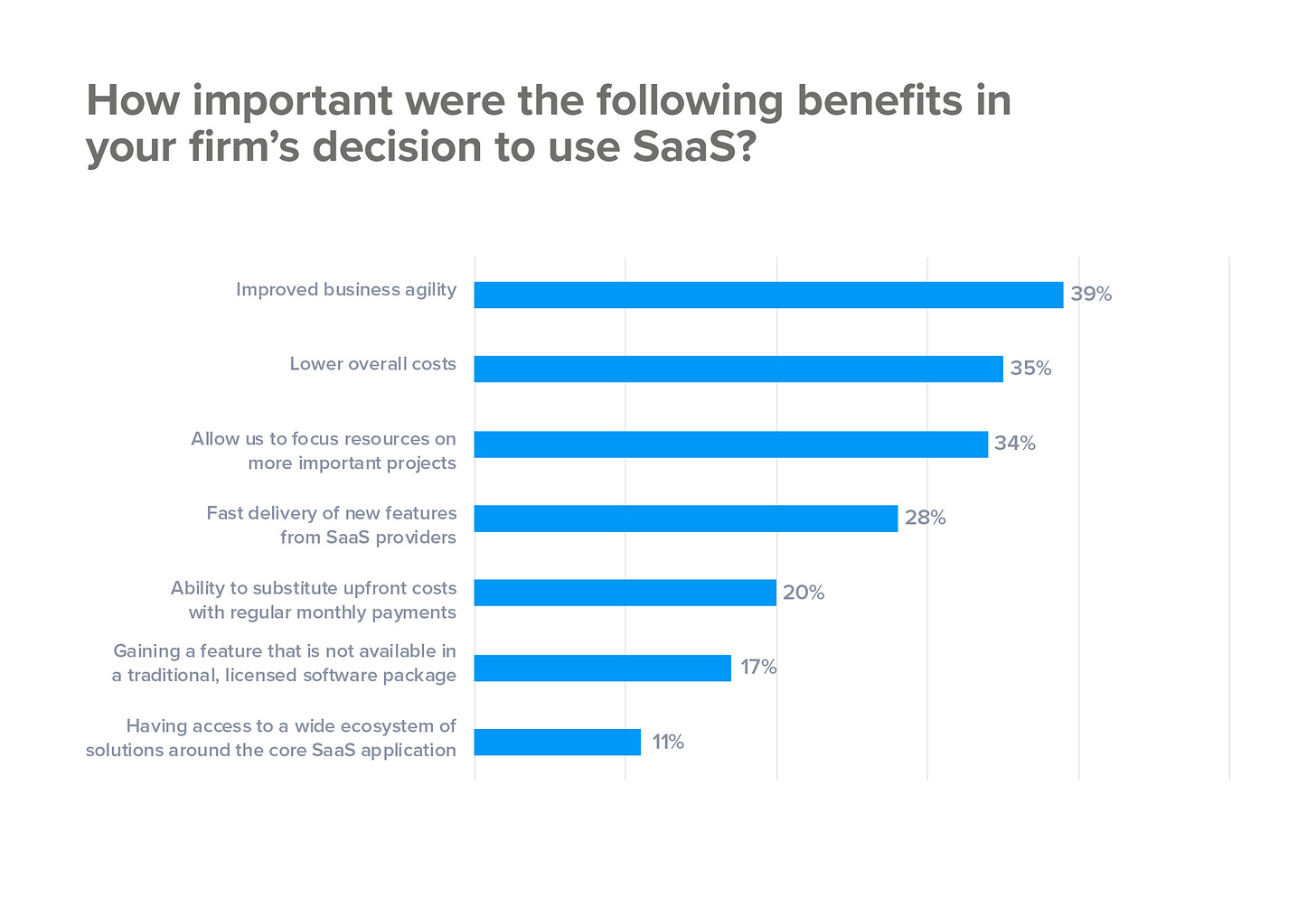

For the enterprise, SaaS offers cost savings, eliminating the upfront cost of purchase/installation as well as ongoing costs such as maintenance and upgrades. Maintenance and upkeep too, are shifted from enterprises’ IT departments to the software vendors themselves. Additionally, because the software is hosted externally by a vendor, changing usage plans no longer required tacking on additional servers. Enterprises saved money and became more agile.

Source: Superoffice.com

For the developer, a subscription model offered an initial investment, but (assuming high retention), a constant stream of cash flows in perpetuity. See below for ROI graph on SaaS company.

Source: forentrepreneurs.com

b. Cloud Computing Takes Off

A major roadblock for software development in the 90s was the complexity of software increasing at rates faster than the hardware’s capability of handling it. Servers on premise were expensive to maintain, and expanding the load on these servers were costly. Prior to services like AWS, rising software / internet companies had to gauge the potential traffic of their applications and host them on an approximated amount of servers. Developers built applications from the ground up. Fixed costs were high, and software was not easily scalable.

Amazon launched AWS (first in 2002, then again in 2006), aimed at delivering a suite of cloud-based computing services to customers who would pay only what they would use. In 2006, Amazon launched Elastic Compute Cloud (EC2), a commercial web service allowing small companies and individuals to rent computers to run their own applications on. This made web-scale computing easier for developers and democratized all computing resources for the first time commercially.

Google (2008), Microsoft (2010), Alibaba (2009) followed shortly after, offering a wide range of services at low, scalable costs to all software developers.

Source: Statista

c. The Marriage of SaaS and Cloud

With lowered barriers to entry, a proven business model, and the old guard’s suite of software capabilities proving clunky and inefficient, the mid-2000s ushered a wave of cloud-native SaaS companies.

Since Salesforce went public in 2004, there have been 70+ pure play SaaS/cloud companies that have followed in the public markets, most of which were founded in the mid/late 2000s boom. Some to highlight:

Workday (launched in late 2006) offers subscription-based HCM and financial management applications from time tracking, procurement, and employee data, to expense management

Atlassian (founded in 2002) offers main workflow management and organizational tool JIRA** (see note below)

Hubspot (founded in 2006) provides CRM software

ServiceNow (founded in 2003) specializes in IT service management, IT operations management, and IT business management

Asana (founded in 2008) team collaboration and work management software

Slack (founded in 2009) collaboration and chat platform

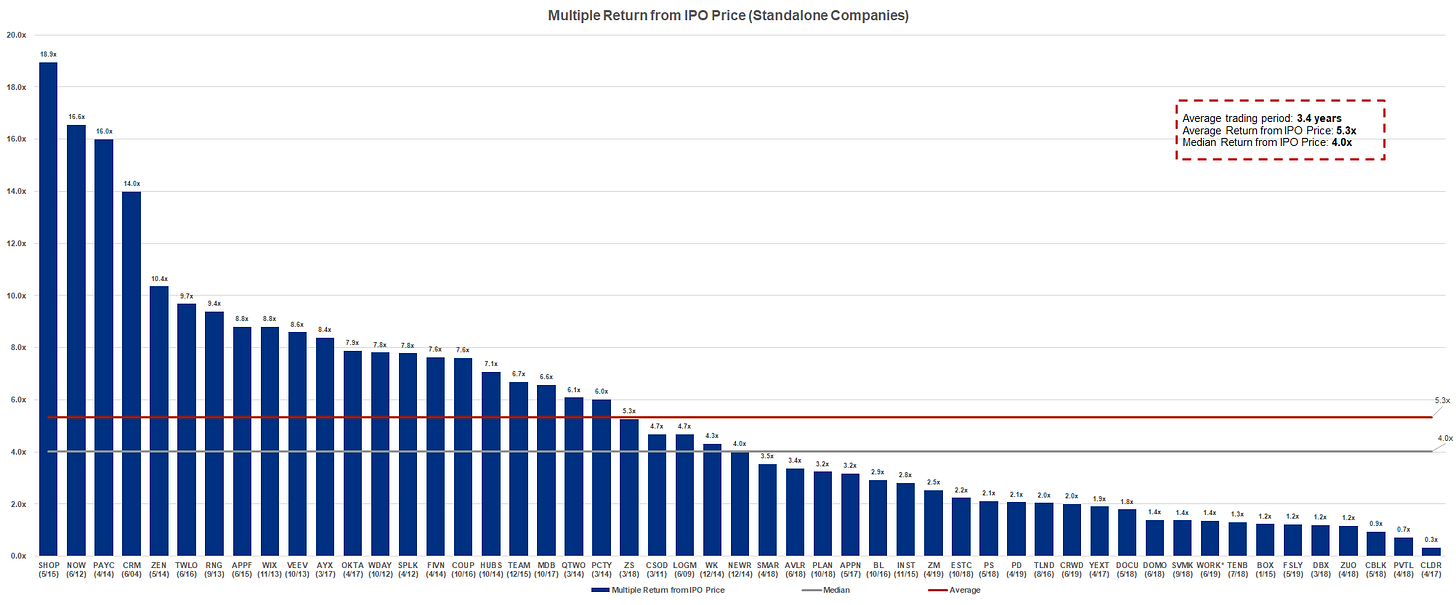

These companies have done extremely well to date, returning an average of 5.3x over IPO price in the (on average) 3.4 years they’ve traded.

Note: The data is as of July 2019.

Source: Alex Clayton - Medium

Enterprise adoption of these applications corroborate SaaS’ overall success and momentum, with the average enterprise using ~1,071 cloud services.

Source: Transposit blog

part 3 - vertical SaaS on the rise

The earliest SaaS products (listed above) began “horizontally”, meaning they served a single function for a wide range of industries. I.e. Salesforce CRM is offered in finance as well as e-commerce. As momentum in the SaaS ecosystem rallied, some software companies started tackling solutions for industry-niche problems. Thus formed the “vertical SaaS”.

Source: mucker.com

Vertical SaaS companies position themselves as software leaders in the field they dominate, from healthcare (Veeva) to fitness (Mindbody). Though upon face value, they seem to take up a smaller TAM, the unit economics of vertical SaaS are phenomenal. They usually require a smaller sales team (lower CAC), and have lower churn (high LTV). Industry players also benefit as processes not covered by horizontal players are streamlined by these vertical software providers utilizing the same level of agile, cloud-based, SaaS model expertise with an industry-specific approach. A good detail of the ins and outs of vertical SaaS can be found here.

Notable and/or successfully IPO-d vertical SaaS companies of the era include:

Service Titan (founded in 2007) provides all-in-one business management software for HVAC, electrical, and other home services. Offers marketing analytics, mobile workforce, CRM, operations workflow, business analytics, AP/AR, payments, and financing

Mind Body (launched in 2005) provides inventory management and payment platform in the fitness/wellness space. Also offers CRM, business analytics, marketplace, and operations workflow

Procore Technologies (founded in 2003) construction management software including CRM and mobile workforce, AP/AR, and operations workflow

Veeva (founded in 2007) pharmaceutical management software encompassing entire R&D process to market

Other more recently founded vertical SaaS companies include:

Weave (founded in 2011) which raised a $70mm Series D in late 2019 at a $970mm valuation offering CRM and software telephone services for SMB doctors offices

Toast (founded in 2012) which raised a $400mm Series F in Feb 2020 at a $4.9bn valuation offering POS + all-in-one software (inventory management, employee management, online ordering, CRM, reporting, etc.)

Shopify (founded 2004; offered e-commerce software in 2008) which is an all-inclusive e-commerce platform

Select largest vertical SaaS companies by valuation:

Source: Forbes

Needless to say, in 2020, nearly every industry, from restaurant to healthcare, has seen some form of disruption through vertical SaaS. New companies, founded in the late 2010s through the proliferation of cheap capital now splatter Fortune’s Term Sheet with the latest and greatest software solving industry-specific problems.

But is that it? Is this the end for vertical SaaS? A bunch of point solutions for vertical specific problems? Is there a chance that rebundling will happen after the decades long swing of unbundling SaaS? In the next post, I will cover what the landscape spells out for the next wave of vertical SaaS.

Thanks for reading, and stay tuned!

Edits:

*edit: Thanks @sandykory for the clarification. Atlassian started on-prem with an upfront payment model, only shifting to SaaS in 2010 - 2013